Auditing in the UAE: 5 Big Changes Businesses Need to Know

But the landscape is shifting. The UAE is becoming the new economic hub of the world. Things are changing fast in this part of the world. New technologies, stricter rules, and evolving global standards means audits are totally transformed too.

These changes have implications for businesses. There are things businesses need to do the new way, the right way for compliance and acceptance.

In this article, we’ll cover five major changes you need to know. These shifts will impact how businesses report finances, handle compliance, and manage risks.

Stay ahead with practical tips to navigate these updates and keep your business audit-ready.

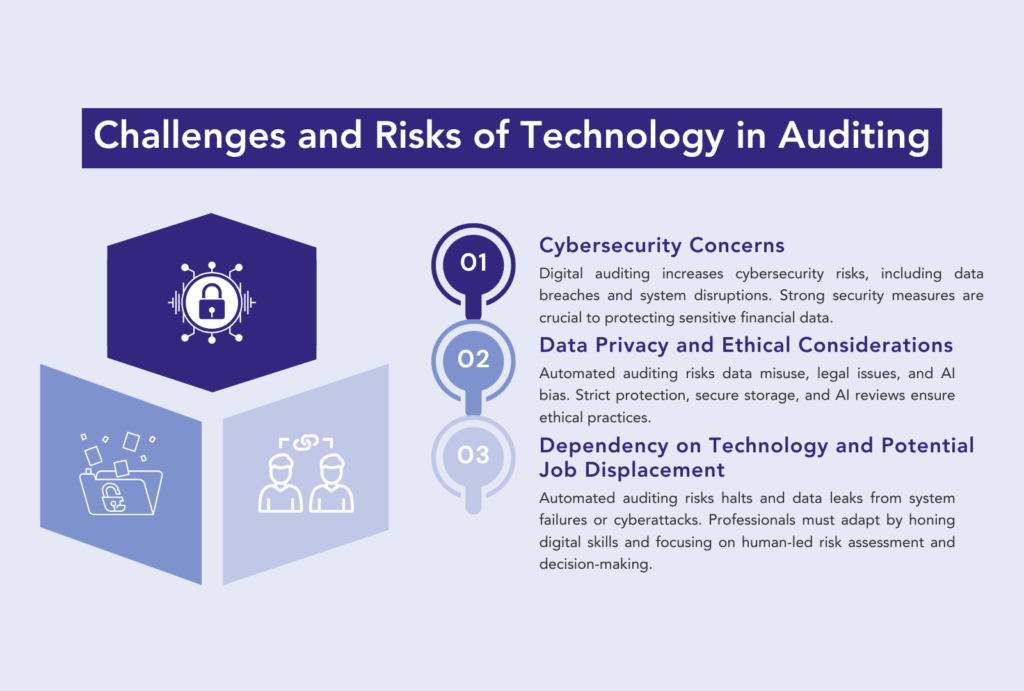

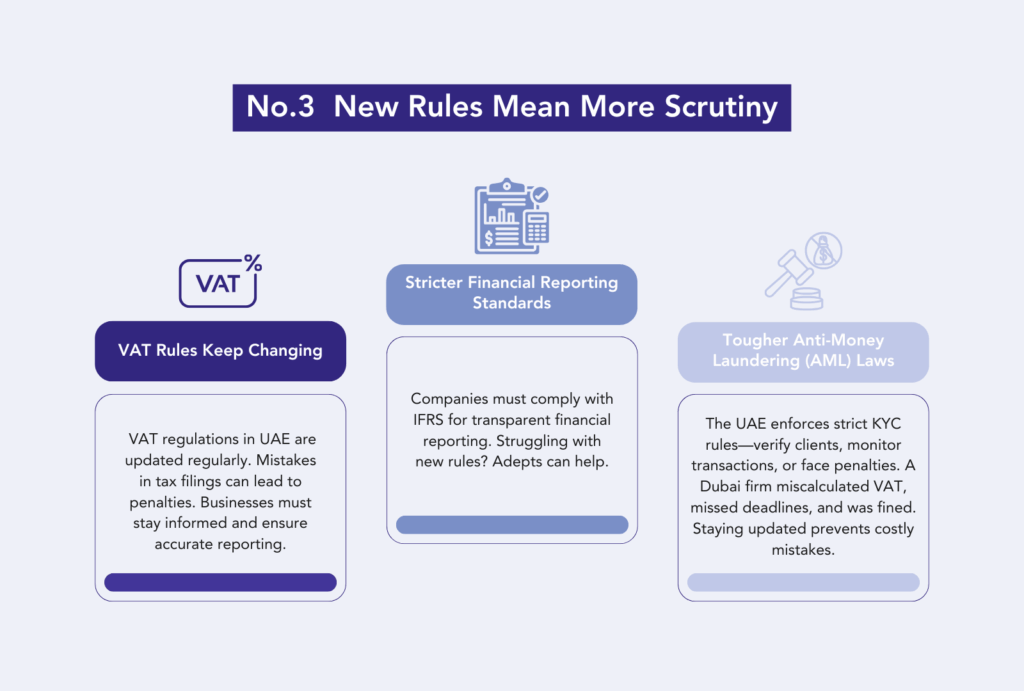

1- Tech is Taking Over Audits

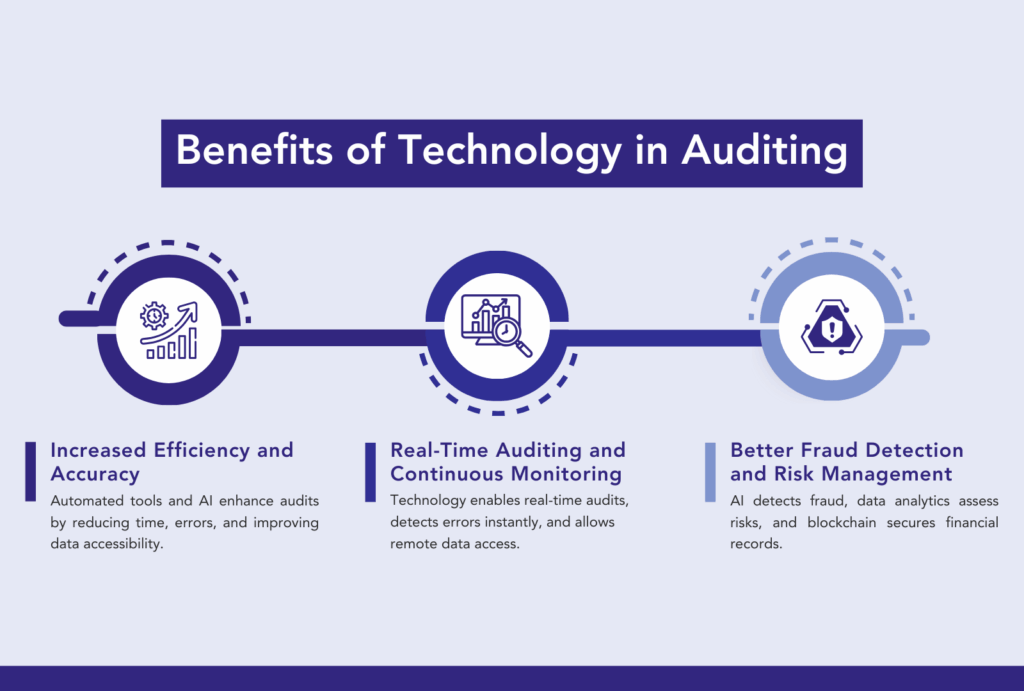

Financial Auditing services are not the same anymore and the main factor behind this change is the technology. Manual checks and spreadsheets are the works of the past. Automation, artificial intelligence (AI), and data analytics are the new norms. These tools are making it all faster, more accurate, and cost-effective.

Robotic Process Automation (RPA): Speeding Up Audits

RPA is software that performs repetitive tasks automatically. It can extract financial data, check invoices, and generate reports in minutes—something that used to take hours or even days. This not only saves time but also reduces human errors. This means detection of errors and frauds in auditing is so much easier now. Auditors can now focus on deeper analysis rather than routine tasks.

For example, many UAE companies are using RPA to handle large volumes of financial transactions. Instead of manually checking thousands of invoices, the system does it instantly, flagging discrepancies for auditors to review.

Artificial Intelligence (AI): Smarter Audits

AI has totally changed the game for audits because it can do things that humans can’t. It can identify patterns and risks that humans will miss easily. It analyzes financial data, detects irregularities, and even predicts fraud. Instead of just reviewing past records, AI can forecast potential financial risks, helping businesses stay ahead.

Imagine a company in Dubai that processes thousands of transactions daily. With AI-powered tools, the system can instantly detect unusual spending patterns or errors. This improves accuracy and reduces the risk of financial fraud.

Data Analytics: Better Business Insights

Traditional audit firms mainly focused on compliance and historical data. But with advanced data analytics, things are different. With these innovations, businesses can now gain real-time insights. The advanced tech tools analyze large datasets and with their help, auditors detect trends, predict risks, and provide strategic recommendations.

For example, a retail business in Abu Dhabi uses audit analytics to track sales trends, identify cash flow issues, and optimize financial planning. This turns audits from a regulatory task into a business advantage.

If your business is still doing manual audits, it’s time to upgrade. Explore audit software, test AI-driven solutions, and consider RPA tools. Start investing in technology and your audits will be faster, more efficient, and more accurate.

2- Focus on Risk Management

Speed and accuracy are the given factors of the new technology but AI has done even more for business audits. Audits aren’t checking financial records now. Modern audits are actually risk proofing businesses with AI tech. Smart technology now identifies vulnerabilities and let managers know how to save businesses from potential instabilities.

Businesses have to deal with many risks like economic downturns, regulatory changes, cybersecurity threats, and not to forget financial fraud. Modern audits with Ai can detect the risks while analyzing massive data and they can also direct businesses to hedge against them.

Identifying Key Business Risks

The first step in risk management is identifying potential threats. These can come from various sources:

- Market Changes – Economic shifts, inflation, or disruptions in supply chains can impact profitability.

- Regulatory Updates – The UAE regularly updates business laws. Companies that fail to comply face heavy fines.

- Cybersecurity Threats – With digital transactions increasing, businesses are more exposed to cyberattacks. A recent report found that 60% of UAE firms now face new cybersecurity risks.

- Operational Risks – Internal issues like fraud, mismanagement, or outdated technology can weaken a company’s stability.

Assessing the Impact of Each Risk

Once risks are identified, businesses must measure their potential impact. This means asking questions like:

- How much financial damage could this risk cause?

- How likely is it to happen?

- What areas of the business would be affected?

For example, a retail company in Dubai might assess the impact of supply chain disruptions. If a key supplier fails, how will it affect inventory levels and revenue? Understanding these risks helps businesses prepare.

Creating a Plan to Reduce Risks

The next step is prevention. Businesses need strong risk management plans to minimize damage. This can include:

- Updating cybersecurity defenses to prevent data breaches.

- Training employees to recognize fraud or compliance risks.

- Diversifying suppliers to reduce dependence on one source.

- Reviewing insurance policies to cover financial losses.

Case Study:

A major UAE bank ran an internal audit. The results were worrying. Their online banking system had weak security controls. Customer data was at risk. The audit team flagged the issues. The bank acted fast. They strengthened security, added multi-factor authentication, and trained staff to handle threats.

Six months later, the impact was clear—attempted cyberattacks dropped by 40%. This proves one thing: audits don’t just check numbers. They help businesses spot and fix risks before they turn into real problems.

Risk management isn’t a one-time task. Businesses must review and update their risk plans regularly. Conduct internal audits, monitor threats, and adjust strategies as needed. A proactive approach can save your company from costly mistakes.

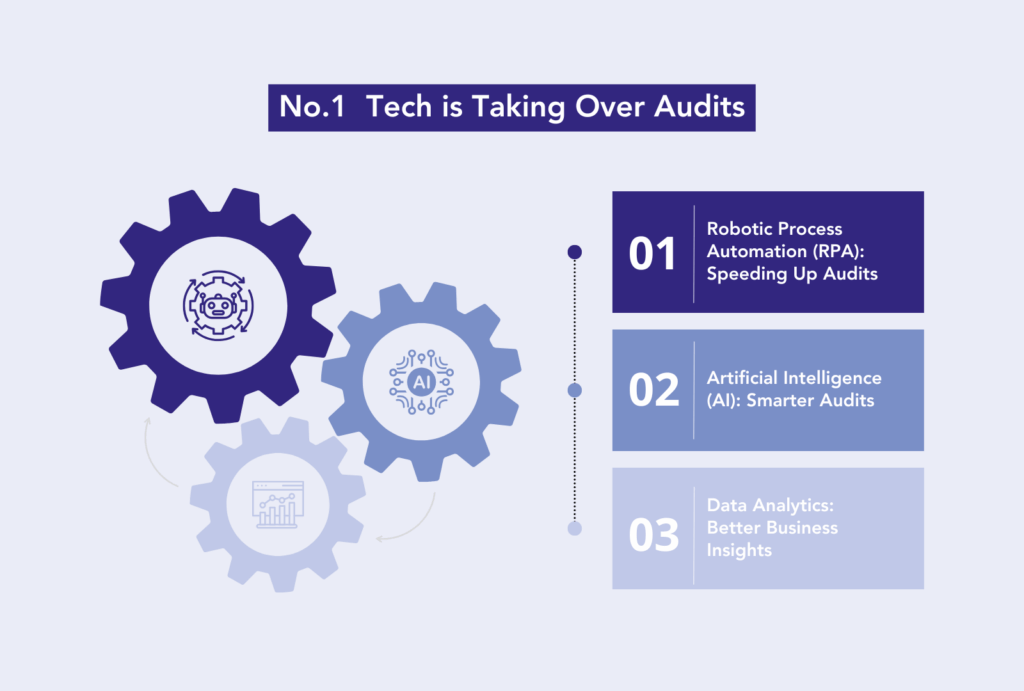

3- New Rules Mean More Scrutiny

The UAE is becoming an international business hub and that has repercussions for businesses. The government is tightening its audit rules. Businesses must keep up. Falling behind could mean fines or legal trouble.

Tax laws, financial reporting, and anti-money laundering (AML) regulations are getting stricter. Audits now go beyond checking records—they ensure full compliance with the latest laws.

VAT Rules Keep Changing

VAT regulations in the UAE are updated regularly. Mistakes in tax filings can lead to penalties. Businesses must stay informed and ensure accurate reporting.

Stricter Financial Reporting Standards

Companies must now follow International Financial Reporting Standards (IFRS). These global rules ensure transparency and accuracy in financial statements. If your reports don’t meet IFRS standards, auditors will catch it.

Lots of new rules and complications can make things difficult. If you need help with Financial reporting under new rules and with the latest technology, Adepts can help.

Tougher Anti-Money Laundering (AML) Laws

The UAE is cracking down on money laundering. Businesses must follow strict Know Your Customer (KYC) rules. This means verifying client identities and tracking suspicious transactions. Ignoring these rules can lead to serious consequences.

Real-World Example: VAT Mistake Leads to Fine

A trading firm in Dubai made errors in its VAT filings. They miscalculated input tax and missed deadlines. During an audit, the mistakes were found. The result? A hefty fine from the authorities. If the company had stayed updated on VAT changes, they could have avoided this costly mistake.

Actionable Tip:

Don’t wait for an audit to expose compliance issues. Get expert advice. Attend workshops and training sessions. Stay ahead of new rules to protect your business.

4- Sustainability is Key

Audits in the UAE aren’t just about finances anymore. They now look at how businesses affect the environment. And the pressure is growing. Governments, investors, and customers all expect greener practices.

But going green isn’t just about compliance. It is the smart thing to do in these times. A sustainability audit helps companies see their impact, cut waste, and improve efficiency. It means it saves money for businesses and even wins over governmental funds and support in the UAE.

Sustainability aspect cannot be ignored now. The UAE government is investing heavily in sustainability. Businesses will benefit if they follow the trend. If your business is not complying, It can mean lost customers, higher costs, and stricter rules.

Check Energy Use: Cut Costs & Pollution

Energy waste is a common issue in businesses. Many companies leave lights, air conditioning, and equipment running longer than needed. When your company goes for a sustainability audit, it means the businesses power consumption will be checked. The audit will measure waste and there will be suggestions for improvements.

An audit can suggest using LED lighting because this simple measure can cut electricity costs by up to 70%. If businesses choose smart thermostats, electric bills can come down and cooling systems will also be optimized. All of these measures and others like these will aim at reducing a business’s carbon footprint.

Review Waste Management: Reduce, Reuse, Recycle

Waste disposal is another area that audits now cover. Businesses that manage waste efficiently can reduce expenses and avoid environmental penalties.

A good waste audit answers key questions:

- How much waste does your business produce?

- Are recycling programs in place?

- Can materials be reused to lower costs?

For instance, some UAE retail stores have switched to biodegradable packaging instead of plastic. Restaurants are reducing food waste by donating excess food to local charities. These efforts save money, build goodwill, and attract eco-conscious customers.

Examine Supply Chains: Ethical & Sustainable Practices

Sustainability isn’t just about what happens inside a company. It’s also about where materials come from. Audits even check the source of materials and also the way products are manufactured. Sustainability audits make sure businesses aren’t following any procedures, processes or even sources for materials that may be linked with harming the environment in any way.

Consumers Want Green Businesses

The more people learn about climate change, the more they worry. They feel responsible. In order to make amends, they back and appreciate businesses that work for the environment. If your business is still thinking about going green, they are losing customers.

Actionable Tip:

Start with a green audit. Assess your energy use, waste management, and supply chain ethics. Look for areas to improve. If your business starts focusing on reducing energy consumption or something like it, customers are going to love the move. Eco conscious appreciate and encourage such small but significant moves.

5- The Rise of Remote Audits

There is something new at every corner. Like remorse audits. Business audits no longer need in-person meetings and stacks of paperwork. Remote audits are the new norm. They save time, cut costs, and make the process more efficient.

Faster, Easier, and More Flexible

With remote audits, businesses don’t need to schedule long office visits. Video calls replace face-to-face meetings. Auditors can check records without stepping into your office.

Documents are shared online through secure cloud platforms. This speeds up the process and reduces paperwork. Instead of waiting for auditors to travel, businesses can get audits done faster—sometimes in days instead of weeks.

Real-Time Monitoring

Technology allows auditors to track financial records and compliance remotely. Businesses can grant auditors limited access to systems, making the process seamless. This is especially useful for companies with multiple locations or digital operations.

For example, a UAE-based e-commerce company used remote auditing tools to review inventory, sales records, and tax compliance without disrupting daily operations. The result? A smooth audit with zero downtime.

Access to Global Experts

Remote audits also mean businesses can work with top auditors from anywhere in the world. No need to rely only on local experts. This brings fresh insights and ensures compliance with international standards.

The best thing for businesses is to invest in remote technologies. Overhead charges can be brought down. Things like audits can speed up. No hassle, no extra charges. Work done!

Conclusion

Audits in the UAE are changing. Tech is leading the way. Risk management is a priority. Rules are getting stricter. Sustainability matters more. Remote audits are the new norm. Businesses must keep up.

If you are ignoring these changes, you are crafting your failure yourself. You’ll fall behind and that’s a bad news. Falling behind could also mean fines, inefficiency, or lost trust. But adapting comes with big benefits. Audits can help businesses save money, prevent risks, and improve operations.