Tax and Visa Benefits of Establishing a Business in Ajman Free Zone

Dreaming of a tax-free business haven? Ajman Free Zone offers just that.

The location and the business-friendly policies of Ajman Free Zone UAE are the biggest attractions for the businesses and investors all around the world. Be it starting a new business or trying to expand, Ajman Free Zone offers a wide range of benefits.

It’s not just the modern infrastructure and commitment to innovation that makes it attractive, AFZ has an important role in the UAE’s economic success and provides a strong foundation for long-term growth.

In this article, we’ll discuss why so many international businesses choose Ajman Free Zone. We will also discuss a variety of advantages including its most attractive benefits of tax incentives and flexible visa solutions.

Keep reading to see why Ajman Free Zone business setup might be the ideal place for your next business move.

Tax Advantages in Ajman Free Zone: Maximize Your Profits

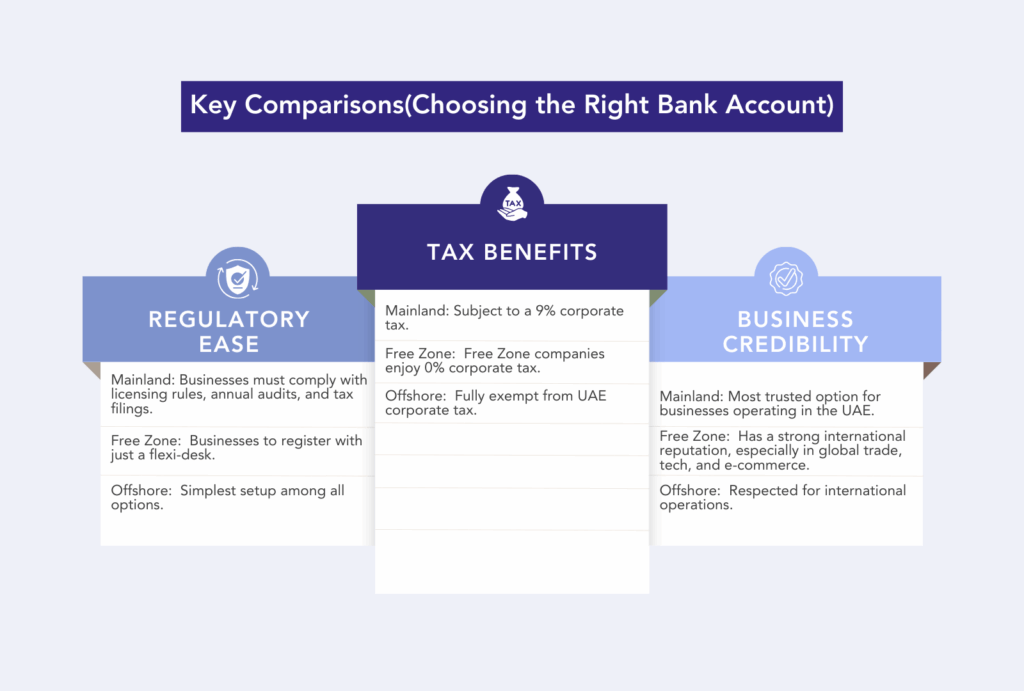

One of the biggest advantages of setting up in Ajman Free Zone UAE is the highly attractive tax environment. With no personal income tax and the possibility of 0% corporate tax, investors can retain more profits while enjoying full ownership and operational flexibility.

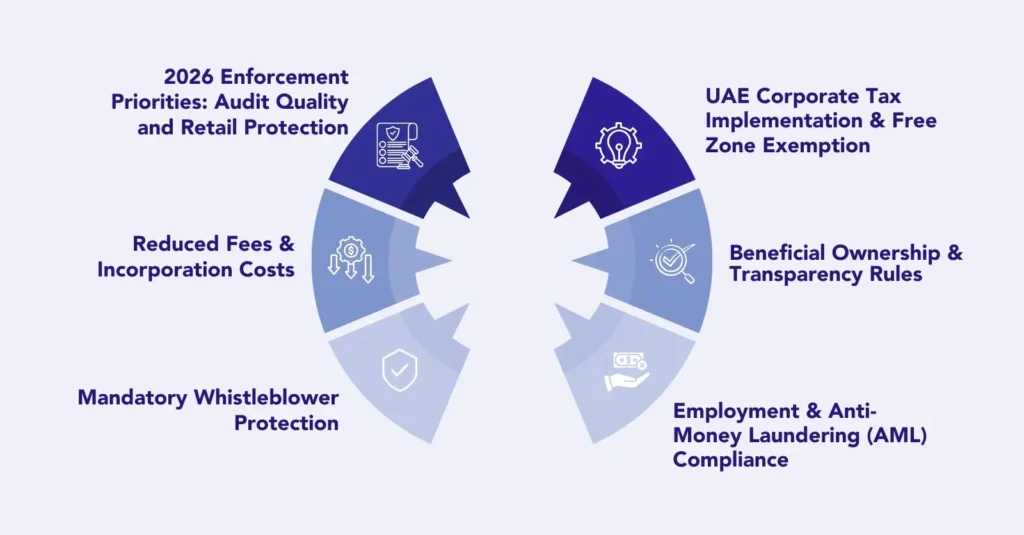

However, 0% corporate tax isn’t automatic. To qualify, a business must meet all of the following conditions set by the UAE Corporate Tax Law:

- Be incorporated or registered in a Free Zone (including branches).

- Maintain adequate substance in the Free Zone.

- Earn qualifying income.

- Not elect to be taxed under the standard UAE CT regime.

- Comply with transfer pricing and documentation rules.

- Ensure that non-qualifying income stays within the “de minimis” limit.

- Prepare audited financial statements in accordance with IFRS.

Failing to meet even one of these can result in a 9% tax on total income for the current year and the following four years. After that, the business can apply to regain the 0% tax status in the sixth year.

Disclaimer: Please consult a qualified advisor or the Free Zone authority for personalized guidance.

100% Foreign Ownership: Retain Full Control

One of the standout features of having an Ajman Free Zone company setup is the ability to maintain 100% foreign ownership. This gives investors complete control over their business operations. Moreover, it eliminates the need for a local sponsor or partner, making company formation in Ajman Free Zone appealing to international entrepreneurs.

Zero Import and Export Duties: Trade Freely

Ajman free zone company formation allows you to trade without paying import or export duties. Import duties are not charged as long as the goods remain in the free zone. However, as soon as the goods move into the mainland, import duties must be paid immediately. This helps reduce costs for your business. It’s ideal for companies involved in global trade. With the Ajman free zone trade license, your business becomes more competitive in international markets.

No Currency Restrictions: Easy Fund Transfers

There are no currency restrictions with Ajman Free Zone company setup. This means you can move your money in and out of the UAE without limits. It helps businesses send profits to their home country or pay international suppliers with ease. This kind of financial freedom makes Ajman Free Zone company formation a smart choice for global investors.

However, it’s important to note that while there are no currency restrictions, UAE banks follow strict anti-money laundering (AML) regulations. This includes Know Your Customer (KYC) procedures and transaction monitoring, which apply equally to free zone businesses. These controls are designed to ensure safe and legal financial practices across the country.

Visa Options in Ajman Free Zone: Streamlining Your Workforce

Ajman Free Zone UAE offers the following visas:

Investor Visas: Secure Your Residency

Ajman free zone visa options make it simple to bring in the people you need. You can apply for

- investor visas,

- employee visas,

- and even family visas.

This helps you build and support your team without hassle. With flexible Ajman free zone visa rules, managing your workforce becomes easier.

Employee Visas: Build Your Team

With Ajman free zone company setup, businesses can easily sponsor employees under the free zone’s regulations. The process includes

- submitting a visa application,

- completing medical tests,

- and getting an Emirates ID.

It’s simple and efficient, making Ajman free zone visa management easy for growing teams.

Family Visas: Bring Your Loved Ones

Planning to move for work? With the Ajman free zone visa, you can bring your family with you to the UAE. To do this, you’ll need

- a valid investor or employee visa

- proof that you can support them financially.

- And a proof of relationship and residency status

This makes it easier for expatriates to balance work and family life in the UAE.

Cost-Effective Business Setup: Save Money

Setting up your business doesn’t have to break the bank. Company formation in Ajman Free Zone is known for its competitive pricing and budget-friendly options.

Affordable Licensing Packages: Find the Right Fit

Looking into Ajman Free Zone business setup? The good news is AFZ offers plenty of license options. Whether you’re a freelancer, a startup, or already running a business, Ajman Free Zone UAE has something for you.

Here are some popular choices:

- Freelance License – Great for solo professionals. Starts from AED 6,000.

- Trading License – Perfect if you want to import or export goods. Packages start at AED 12,000.

- Service License – If you’re offering services, this is a good pick. Starts from AED 9,000.

- Industrial License – For making or manufacturing products. Starts at AED 12,000 (plus warehouse charges).

- E-Commerce License – For online businesses. Starting from AED 14,000.

- Pioneers License – Made for young entrepreneurs (ages 20–30). Starts from just AED 5,000.

Ajman Free Zone company formation cost is one of the best in the UAE. While Dubai free zones can get expensive, Ajman Free Zone licence packages are much easier on your budget. You still get all the essentials, without the heavy price tag.

Choosing Ajman Free Zone company setup can help you save up to 20% compared to other zones. So if you’re looking for affordable and flexible options, Ajman Free Zone UAE is definitely worth looking into.

Simplified Registration Process: Get Started Quickly

Setting up your business in Ajman Free Zone UAE is very simple.

Here is what you will need to do:

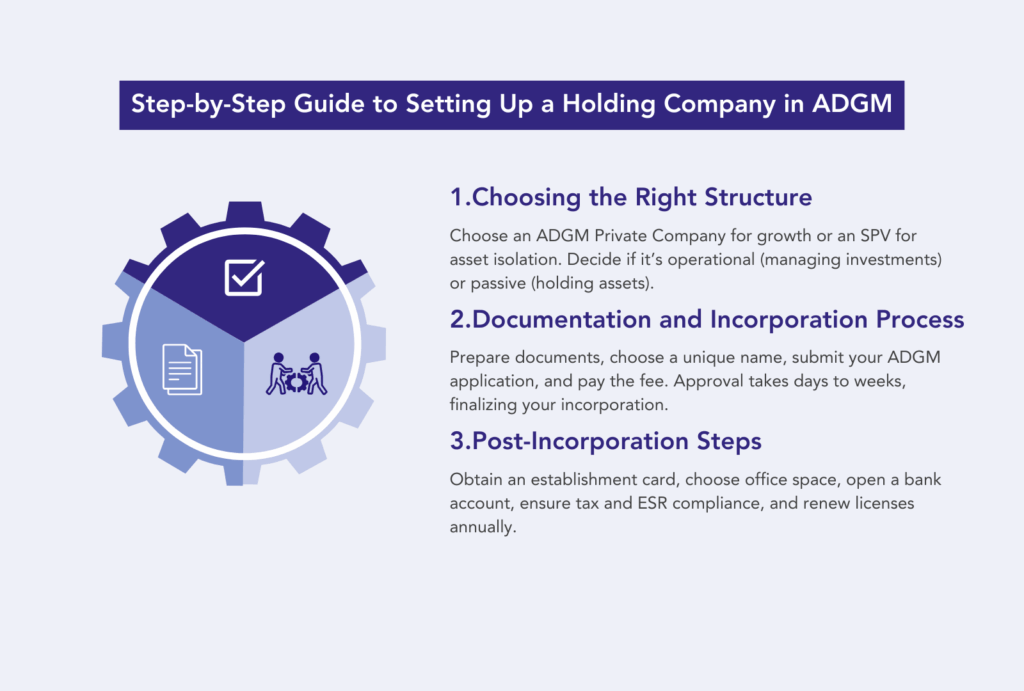

- Choose your license – Pick the right one based on your business type.

- Submit documents – Basic documents like passport copy, photo, and application form.

- Get approval – This part is fast, usually within a few working days.

- Make payment – Once approved, you pay the fees for your Ajman Free Zone license.

- Receive your license – You’re ready to go!

One of the most convenient aspects is that the majority of the process can be completed online and the Ajman Free Zone business setup portal is very helpful as well. It lets you track your progress and talk to support if needed. In fact using the free zone’s online tools. They make company setup in Ajman Free Zone much faster and smoother.

Whether you’re planning a Ajman Free Zone company setup or just exploring, this process makes things simple. No long queues. No confusion.

Strategic Location and Infrastructure: Connect to Global Markets

No matter what kind of business you run, being well-placed helps save time, cut costs, and keep operations running smoothly. Ajman Free Zone UAE offers just that.

Proximity to Major Airports and Seaports: Easy Transportation

Ajman Free Zone UAE is near major transportation hubs. This makes it ideal for businesses who need efficient supply of goods. With quick access to airports, and nearby seaports, shipping becomes much easier.

This proximity simplifies supply chain management, allowing goods to move smoothly and without delays. No matter the type of business, being this well-connected can make daily operations more reliable and cost-effective.

Modern Infrastructure: Reliable Services

Ajman Free Zone UAE is built with modern infrastructure that supports all kinds of businesses. A smooth road network, dependable utilities and fast internet, everything is designed to keep operations running efficiently.

Businesses also benefit from strong IT support and reliable communication systems, two things that are essential in today’s fast-moving world.

Thriving Business Community: Network and Grow

Being surrounded by the right people makes your business grow much more easily, and Ajman Free Zone ensures it gives its businesses all the opportunities to do so.

Networking Events and Seminars: Connect With Peers

Ajman Free Zone UAE regularly hosts networking events and seminars that bring businesses together. These gatherings create chances to meet potential partners, share ideas, and grow your client base, boosting both visibility and opportunities.

Support Services and Resources: Get the Help You Need

In the Ajman Free Zone UAE, businesses get the help they need to grow. You can get legal advice, marketing help, and other expert support whenever you need it. Apart from this startups also have access to incubation programs. These programs offer mentoring, resources, and a supportive community to grow in.

Conclusion

Ajman Free Zone UAE is one of the top free zones in the UAE. It offers businesses amazing opportunities to grow, with its tax relaxations, easy visa options and affordable business setups. Its prime location gives the businesses the opportunities to grow and establish an international network.

FAQs:

Yes, you can upgrade or change your business license. Submit a request and the following documents through the customer portal

- A formal application/request letter for the change

- Your existing trade license

- Passport copies of the owner/partners

- Any updated business plan (if needed)

- No objection letter (if applicable)

- Payment for the license change/upgrade fee

Investors need to be aware of extra costs like

- office space,

- warehouses,

- or even additional licensing fees

Ajman Free Zone UAE generally offers faster visa processing times and higher approval rates compared to many other free zones.

Activities like banking, insurance, and real estate development are discouraged or not allowed in the Ajman Free Zone. So, make sure your business does not fall into any of these categories.

Yes, with certain licenses, you can operate outside the Free Zone or even in other Emirates. But you might need some specific permissions.

Ajman Free Zone offers government support, and the UAE has strong systems to help resolve business disputes as well.

Yes, you can operate a virtual business in Ajman Free Zone (AFZ). However, the availability and specifics of virtual office options can vary based on your chosen business license type.

Closing or selling your business is easy, however, there are some legal and admin steps to go through.

References

‘Ajman Free Zone Licence: Benefits, Types, & How to Obtain?’ Filings.Ae, https://filings.ae/guides/ajman-freezone-license.

Top Reasons to Set up Your Business in Ajman Free Zone. https://afz.gov.ae/en/resources/blogs/2024/top-reasons-to-set-up-your-business-in-ajman-free-zone.html.